If you are a builder or broker in the construction industry it is imperative that you understand the differences between Run-Off and Transfer Annual Construction Works Insurance cover. As you can appreciate, Construction Insurance is one of the most complex areas of Commercial Insurance. This means that any misunderstandings about these policies can leave builders exposed.

What is Annual Construction Insurance?

An Annual Construction Works policy, otherwise known as a Contract Works policy, provides cover for multiple construction projects during the policy period.

It is standard practice in the Australian construction market to provide two optional covers for Annual Construction Works policies that are available to head contractors and builders; these options are Run-Off and Transfer.

What is an Annual Run-Off policy?

Annual Run-Off policies, or Project/Contracts Commencing policies as they are also known, cover projects commencing during the policy period. This run-off cover continues until the construction has ended and If applicable, includes the period of defects liability (even if this is after the policy period has expired).

It is important to note that no cover is provided for projects that commenced prior to the period of the insurance or those that do not meet the characteristics specified in the schedule.

What is an Annual Transfer policy?

Otherwise known as a Turnover policy, an Annual Transfer Construction Works policy insures all projects undertaken during the policy period including defects liability period, if applicable.

There is also an option to cover any projects which commenced prior to inception of the policy, provided these have been agreed with the insurer. All projects must meet the characteristics listed in the schedule and all cover concludes with the expiry date of the policy.

Understanding the differences between these policies is vital

Unless the subtle differences between these two policy options are recognised and acted upon, they can be the undoing of a builder. Take for example the case where a builder changes policy provider and places cover for a Run-Off policy when they had previously held a Transfer policy. The Run-Off policy will not pick up any projects already commenced, and cover under the Transfer policy would cease at the expiry date of the prior policy, potentially leaving projects uninsured.

Whilst we usually advise that the policy basis is not changed and matches the Insured’s expiring policy, sometimes there are very good reasons for switching the builder from one type of Construction Works policy to another. Without the right advice, builders that switch between policy types can experience a gap in coverage leading to increased exposure to risk.

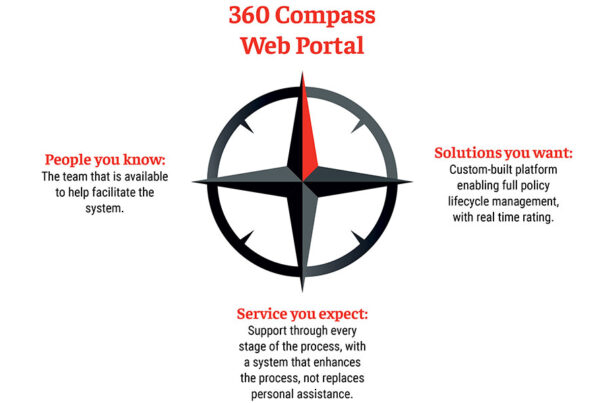

At 360 Underwriting, we have experts available to discuss your specific needs. To speak to 360 Construction & Engineering, call us on 1800 411 580 or send us an email at construction@360uw.com.au.

Please note the information in this article Is general in nature and should not be relied upon as advice, as it doesn’t consider your personal needs, objectives and financial situation. All coverage is subject to the specific terms and conditions contained In the Policy wording.