What is an underwriting agency?

An underwriting agency is a specialised type of insurance agent that has been given underwriting authority by an insurer, according to the International Risk Management Institute (IRMI), they can administer programs and negotiate contracts for an insurer. Essentially, an underwriting agency manages all or part of the insurance business of an insurer and acts as an insurance agent or broker for the insurer, while acting as an intermediary between insurers and agents, and/or insureds.

Why do large insurers work with agencies?

Working with underwriting agencies is beneficial to insurers because they possess expertise that insurers may not have in their head or regional offices, and which can be costly to develop in-house, according to IRMA. Companies can pass time-consuming and complicated tasks to an underwriting agency that already has the knowledge to address them.

Benefits for a broker

Direct placement with large mainstream insurers will always be part of a broker’s day to day. However, for more niche or difficult to place risks an agency can provide solutions. Not only do they have inhouse technical capability and the ability to make decisions quickly but also a solid understanding of the intermediated market and broker expectations.

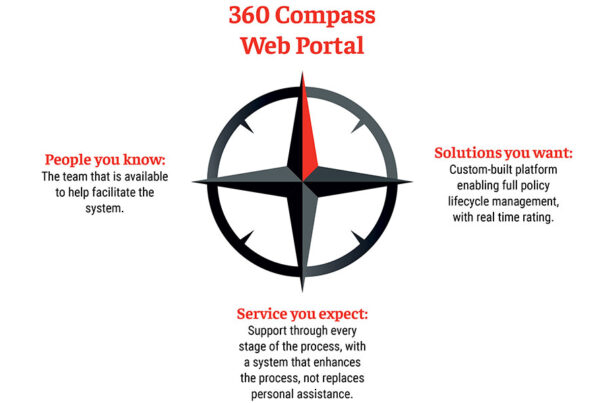

The 360 Difference

Highly regarded for its underwriting expertise and insurance-servicing capabilities in the Australian market, 360 Underwriting Solutions provides underwriters with the independence to make decisions, with coverage in each major capital city. The combination of personal relationships and on-the-ground support sets 360 apart in the Australian agency market.

360 have the ability to provide solutions for you and your clients in the following products:

- Accident & Health | Personal accident and sickness (group, individual and journey). Voluntary workers, corporate travel, Expat/inpat medical expenses, Loss of license

- Anchorage Marine | Pleasure craft and commercial hull insurance

- Aviation | Fixed and rotor wing hull and liability, Infrastructure risks

- Commercial | Asset, business income, crime and liability protection

- Commercial Motor | New fleet motor offering, Optional roadside assistance coverage

- Construction & Engineering | Contract works and liability coverage, Residential owner- builders

- Cyber | Free Avast security

- Farm & Regional | Farm insurance

- Fleetsure | Commercial and heavy machinery motor vehicle fleets

- Landlords | Property, loss of rent, legal liability, and tenant default

- Mid-Market Property | ISR, unoccupied and EPS risks (soon to be released)

- Quick Construct | Annual, project-specific and owner builder construction insurance

- SURA Australian Bus & Coach (ABC) | Bus proprietors’ motor vehicle, depot and liability coverage

- SURA Mobile Plant & Equipment | Mobile plant and machinery, Civil contractors’ insurance

To find out more or get in touch with our team, click here

Source acknowledgment:

Insurance Business Australia