In 2020, two new laws were passed that directly concern the building industry in NSW and will have a corresponding effect on the insurance industry. Given that these changes involve mandatory insurance requirements, insurance Brokers need to be aware of their responsibilities when providing cover to clients based on these new laws. To help Brokers get a handle on these responsibilities, the team at 360 Construction and Engineering have put together a short jargon-free summary of the key points you need to know. Please note, we are insurance experts, not lawyers, so please seek independent legal advice where required.

What initiated these new laws?

Due to the high-profile incidents involving newly constructed defective apartment buildings and issues surrounding combustible cladding, a parliamentary enquiry was established on July 4th, 2019. The final report was submitted in April 2020 and included 20 recommendations for sweeping changes within the building industry. The result was two new laws aimed at improving the quality and compliance of construction work in NSW and rebuilding consumer confidence in the industry.

What do these new laws cover?

There are two key points contained in the Design and Building Practitioners Act 2020 that affect how Brokers formulate cover for their building and construction clients. These are that all design and building practitioners, as well as engineers and specialist practitioners, must be registered and must also declare that their work complies with the Building Code of Australia. The key point of the Residential Apartment Buildings (Compliance and Enforcement Powers) Act 2020 is that it provides an investigative and enforcement arm to the laws that govern the building industry. The Act established the office of a Building Commissioner in NSW with a focus on auditing building sites and identifying defects during construction. These defects will need to be rectified prior to an occupation certificate being issued. For consumers, this Act was designed to prevent them from buying buildings with serious defects.

When will all recommendations from this report come into force?

All of the recommendations of the final report will be implemented in stages and completed by the end of August 2021. The Design and Building Practitioners Act 2020 came into force on June 10th, 2020, but there are a number of sections that will not commence until July 1st, 2021. All changes included in the Residential Apartment Buildings (Compliance and Enforcement Powers) Act 2020, were implemented on September 1st, 2020.

Mandatory insurance requirements

The Design and Building Practitioners Act 2020 sets out a mandatory insurance requirement for all registered design and construction practitioners, including engineers. Regulations to support these requirements have yet to be formulated, however, practitioners will be required to hold professional indemnity and/or warranty insurance.

How do these reforms impact the insurance industry?

Here are the key impacts that these changes will have on the insurance industry.

- Cover for ‘any liability’. Since the Design and Building Practitioners Act 2020 requires that design and construction practitioners must have cover for ’any liability’, this poses a problem for insurers. That’s because the industry does not provide unlimited liability policies. Instead, insurance cover is limited to instances included or excluded in these policies.

- Practitioners to decide on their level of cover: Since the onus for deciding the adequacy of cover will be on the individual practitioner, insurance Brokers will need to assist practitioners in determining the level of cover they require.

- Insurance exemptions: Practitioners do not need professional indemnity cover if they have builder’s warranty cover.

- New insurance products required: Currently there are few insurance products available to cover building compliance declarations. However, since these new insurance requirements are not mandatory until June 30th, 2023, this situation should be resolved within that timeframe.

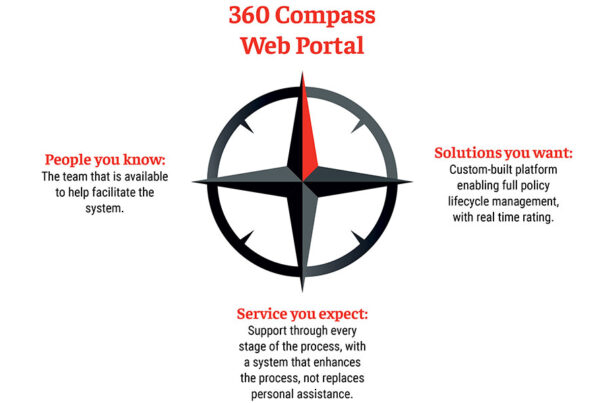

At 360 Underwriting, we have experts available to discuss your specific needs. To speak to 360 Construction & Engineering, call us on 1800 411 580 or send us an email at construction@360uw.com.au.

Please note the information in this article Is general in nature and should not be relied upon as advice, as it doesn’t consider your personal needs, objectives and financial situation. The contents of this article should not be relied upon as legal advice. Please see advice from your independent legal adviser. All coverage is subject to the specific terms and conditions contained In the Policy wording.